International travel insurance prevents you from losing much money when unexpected conditions during your traveling abroad. You might have well prepared and planned before traveling but external factors like flight delays, getting ill or lost luggage happen. It will screw up your plans and cause financial losses.

Whether you are traveling in Malaysia or other countries, travel insurance is crucial. It is very beneficial, especially for a female who travels abroad alone or travelers who stay abroad for a long time. Travel insurance covers various things from lost items to emergency medical treatment at your destination.

Best International Travel Insurance to Protect You in Malaysia

Getting international travel insurance allows you to enjoy worry-free travel in Malaysia. It provides you with peace of mind as it fulfills most international travel requirements. You can get numerous coverage such as trip cancellation, medical expenses, luggage loss, quarantine allowance, and covid-19 care.

International travel insurance will cover you and your family members with easier and better access to high-quality medical services in Malaysia no matter where you stay. Whether you travel often or are a first-timer in Malaysia, these top insurance companies will enable you to explore Malaysia easily and safely.

1. SOMPO TravelSafe

SOMPO TravelSafe provides coverage for unexpected events during your adventures. It offers international travel insurance that is not only beneficial when you are traveling abroad but also exploring the beauty of Malaysia.

Even after the pandemic, travelers are still worried when visiting other countries. SOMPO TravelSafe completely understands this condition so it covers financial losses that might occur when travelers get a covid-19 diagnosis.

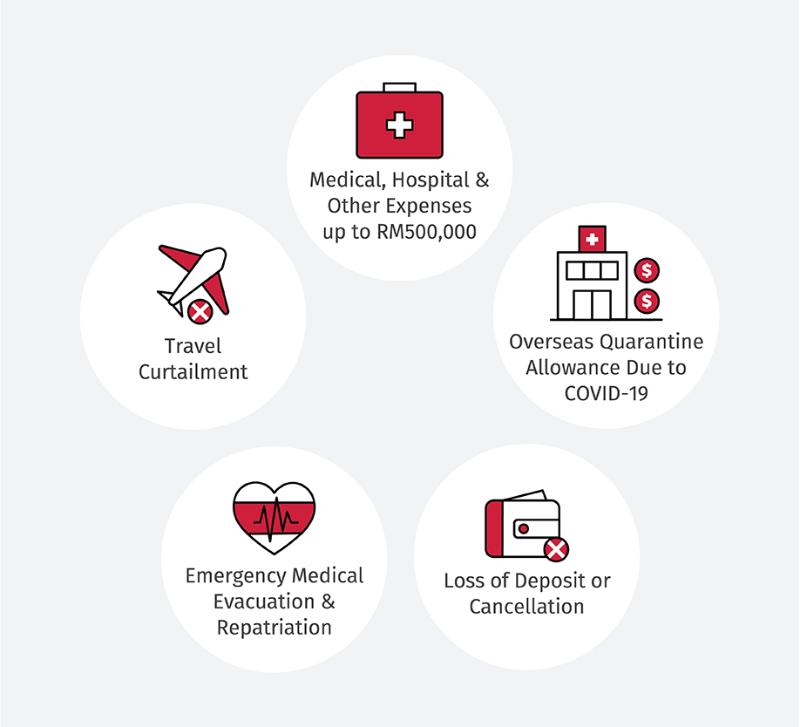

It offers coverage for hospitalization, booking cancelation due to covid-19 diagnosis before the trip, and travel time reduction when you are diagnosed during the trip. International travel insurance from SOMPO TravelSafe covers medical and other hospital expenses up to $105,700.

There is also coverage for emergency evacuation and repatriation you cannot get it from the local health services. Other coverages are travel restriction, quarantine allowance, and loss of deposit.

Benefits of SOMPO TravelSafe Coverage:

- A leading insurance company with the best insurance services and solutions in Malaysia.

- Well-experienced company with world-class services.

- Commits to covering travel inconveniences and providing travel-related benefits.

- Coverage of medical expenses and health on several levels for overseas travel.

2. Chubb Travel Insurance

Chubb Travel Insurance is an ideal option if you want to travel in any country with frequent flight cancellations. However, you can get international travel insurance from this company when you plan to visit Malaysia because it covers up to $10,580. It is not only the best to deal with airport strikes.

Its international travel insurance also provides you backup for travel cancellations because of environmental disasters like floods, earthquakes, tsunamis, volcano eruptions, and many more. If you travel to enjoy some golf experiences in Malaysia, Chubb also provides add-on benefits for you as a golfer.

Benefits of Chubb Travel Insurance coverage:

- High medical coverage.

- International travel insurance is available in a single and annual plan.

- Provide add-on benefits for golfers who travel abroad.

- Travel insurance coverage for leisure and business trips.

- Cover unexpected events like natural disasters, hijacking, and acts of terrorism.

- Global emergency assistance is available 24/7.

- Has covid-19 extension that includes emergency medical treatments, evacuation and repatriation, daily hospital fees, and travel restrictions or cancellations.

3. Tune Protect

Tune project is an insurance company famous for baggage loss coverage on its international travel insurance. The coverage of baggage loss provided by this insurance company accounts for $1057. Although it is the best in baggage loss coverage, the Tune project also provides other coverage for travel.

Among available coverage, there are medical expenses up to the first 30 days of the trip, hospital income, and emergency evacuation and repatriation. It also covers trip restrictions, trip cancelation, compassionate visits, and bereavement allowance. Those coverage presents for solo and family traveling.

An interesting thing about Tune Project is it provides international travel insurance covid-19 coverage and Covid Travel Pass+. The difference between both coverages is covid-19 is only eligible for international travel. Meanwhile, Covid Travel Pass+ is for foreigners who travel to Malaysia.

Hence, if you want to enjoy leisure time by exploring Malaysia yet feel protected from covid-19, you need to choose international travel insurance with Covid Travel Pass+.

Benefits of Tune Project coverage:

- Coverage of permanent disablement, accidental death, and passing away when positively diagnosed during the trip.

- Coverage for flight delay and baggage delay every 6 consecutive hours from arrival.

- Coverage for emergency medical evacuation and repatriation, and mortal remains repatriation.

- Travel assistance service is available 24/7.

4. Allianz Travel Easy

Allianz provides international travel insurance with its “Travel Easy” package. Like most insurance companies, Allianz comes with coverage for both domestic and abroad financial cover for you and your family. Hence, you can get insurance from Allianz during your trip to Malaysia.

This travel insurance helps you to remain calm whenever something unexpected happens during your travel like when you experience travel or luggage delay. Any financial loss caused by those events is under insurance coverage. It includes medical expenses, emergency evacuation, and a repatriation program.

Its international travel insurance also helps deal with permanent disablement or death when accidents happen during the trip. Allianz is highly aware of covid-19 spread so this insurance company includes specific coverage for travelers with covid-19 diagnoses.

Benefits of Allianz Easy Travel coverage:

- Well-experienced and reliable partner for traveling overseas.

- Provide insurance solutions for different purposes.

- Customer focus so it always upgrades the service to meet customers’ needs.

- Open communication with fast response and 24-hours customer service via email or social media.

- Easily accessible insurance products through various channels both virtually and physically.

International travel insurance allows you to experience more enjoyable traveling in Malaysia. Getting insured against unexpected events will prevent you to undergo financial losses during the trip. To ensure you can get benefits from travel insurance, you must choose the right insurance company.

Those top insurance companies can be a good option to protect yourself and your family as they have internationally reputable services. You only need to find the right insurance package in a chosen company.